401k and pensions

-

Pensions are stupid. It's a way of deferring wages; they eat at the wages of the next generation of workers. And it's not a retirement plan for the reason jadero mentioned—same with social security, by the way. It's good to give employees investment in the success of the company beyond their continued employment, but stock options do that better.

You may not like Wall Street, but 401ks are the most humane retirement plan. Pensions and social security are both a stealing from the young to give to the old. This is the ideology of Cronus eating his children. 401ks do the opposite. People are incentivized to keep buying stocks, which is good for the economy, which is good for young people because that means they'll have jobs.

@Jonathan this feels artificially binary. There appear to be big problems with 401ks being the sole retirement option offered to people. We end up with amoral companies doing only what drives stock value. This doesnt have to be “pensions are bad. 401ks are good”. Maybe some elements of both can happen. Maybe a portfolio that includes both. Transition also doesnt have to be immediate, it can be gradual. There is a problem here. Lets identify how we can fix it?

-

@Jonathan this feels artificially binary. There appear to be big problems with 401ks being the sole retirement option offered to people. We end up with amoral companies doing only what drives stock value. This doesnt have to be “pensions are bad. 401ks are good”. Maybe some elements of both can happen. Maybe a portfolio that includes both. Transition also doesnt have to be immediate, it can be gradual. There is a problem here. Lets identify how we can fix it?

@unshittified said in 401k vs pensions:

There appear to be big problems with 401ks being the sole retirement option offered to people. We end up with amoral companies doing only what drives stock value.

What reason do you have to believe that 401ks drive the prioritization of stock value by any significant degree? Or middle class investors at all, for that matter?

Heh, I don't see why my comment was more artificially binary than what you led with, "Companies should not be putting people’s retirement in 401ks. They should have pension funds..." If we want to have a fruitful discussion about these things, we need to have an understanding of why pensions came about in the first place, and then why they were phased out. What was the advantage of them? What made 401ks take over? Was it changing policy that favored 401ks, or do they have genuine advantages? Understanding these things is necessary for making successful regulatory changes.

And if an exploratory discussion of these things led us to believe that, say, pensions filled the niches of (1) being a promise that companies made to draw in prospective workers (which may not ever be fulfilled) and (2) creating some kind of guarantee that older folks that worked manual labor have some social safety net when their body gives out, we might come to the conclusion that pensions were actually discontinued because other things served their function better. In which case, fighting for the return of pensions would be, well, stupid. Not trying to be a jerk about it. Time, effort, and money are limited resources. We should spend them on the things that make the most sense for materially improving the world. I want people to succeed. If 401ks serves normal people better than pensions did, then I don't want to mess with it.

-

@unshittified said in 401k vs pensions:

There appear to be big problems with 401ks being the sole retirement option offered to people. We end up with amoral companies doing only what drives stock value.

What reason do you have to believe that 401ks drive the prioritization of stock value by any significant degree? Or middle class investors at all, for that matter?

Heh, I don't see why my comment was more artificially binary than what you led with, "Companies should not be putting people’s retirement in 401ks. They should have pension funds..." If we want to have a fruitful discussion about these things, we need to have an understanding of why pensions came about in the first place, and then why they were phased out. What was the advantage of them? What made 401ks take over? Was it changing policy that favored 401ks, or do they have genuine advantages? Understanding these things is necessary for making successful regulatory changes.

And if an exploratory discussion of these things led us to believe that, say, pensions filled the niches of (1) being a promise that companies made to draw in prospective workers (which may not ever be fulfilled) and (2) creating some kind of guarantee that older folks that worked manual labor have some social safety net when their body gives out, we might come to the conclusion that pensions were actually discontinued because other things served their function better. In which case, fighting for the return of pensions would be, well, stupid. Not trying to be a jerk about it. Time, effort, and money are limited resources. We should spend them on the things that make the most sense for materially improving the world. I want people to succeed. If 401ks serves normal people better than pensions did, then I don't want to mess with it.

@Jonathan i love this long form answer and i do think its something that needs thought. Maybe we can find some historical reading on the topic that sheds light on why the transitions happened. Of course the effect if those transitions must also be considered. We need to avoid fatalism, and pouring all our retirement money into stocks as it currently stands I think has been proven to be inadequate.

-

Also, to your point i’m going to edit the title. Vs is too dichotomous!

-

@Jonathan I think the problem of having one generation fund the retirement of the previous generation is solvable. I think a big part of the problem is that the funding is coming from the wrong place.

Canada's system of public pensions is a good start. We have the CCP (Canada Pension Plan) and OAS (Old Age Security).

CCP is a mix of employer and employee contributions. It is supposed to be self-contained, with individual benefits actuarially tied to contributions. Whether it actually is or not is an important question.

OAS is tax funded, and this is where a fix for the generational problem might be found. I admit I don't know what that would look like, but a good start might be that whenever a company declares a dividend, an equal amount has to go into the OAS fund. (Just spit balling. I don't have the chops to actually analyze the various impacts of using corporate wealth to fund public pensions.)

-

I have a family member and many colleagues who worked at a company for decades that was sold and the buyer essentially dissolved the pension — the former employees got 1cent on the dollar.

So, yeah, I'm not a fan of pensions, given that it's too easy to see it go up in smoke. Yes, that can happen to a 401k, but if it does, it's not isolated. The best advice to protect earnings is to diversify, both within the portfolio and across a variety of asset tools (the 401k being just one).

-

Alright. I need to read more into the CCP @jadero. @skeet yeah, clearly that isn't going to work.

I understand that 401ks protect peoples money by diversifying their retirement; but this still is dependent on the market constantly going up, and a steady rate of inflation.

The other part I'm wondering about is savings account rates. In the 80s the Fed rates caused savings account to return 8-15% and this has gone down to almost nothing over the subqeuent 3 decades. What's the bigger picture around this? Can this be balanced so that savings accounts yield a comparable rate to a vanguard?

-

and if you economics majors are chuckling as I fumble through this, thanks in advance for explaining it

-

@approxinfinity The savings interest rates thing is strange to me. I just checked Chase and their savings account rate is .01%. Their premium savings account rate is... .02%. Meanwhile CapitalOne has a 3.4% high yield savings. Both are FDIC insured. My uninformed opinion is this feels like a case where they do it simply because they can get away with it.

-

@Jonathan If they do it because they can get away with it then they can be forced to not do it! If we had a decent return on savings accounts, why not have retirement put in a savings account that is untouchable until a certain age, like a Roth?

-

If you don't want to invest in stocks, you can have an entirely Treasuries based 401k. Will it yield much? No, but it's an option!

-

Alright. I need to read more into the CCP @jadero. @skeet yeah, clearly that isn't going to work.

I understand that 401ks protect peoples money by diversifying their retirement; but this still is dependent on the market constantly going up, and a steady rate of inflation.

The other part I'm wondering about is savings account rates. In the 80s the Fed rates caused savings account to return 8-15% and this has gone down to almost nothing over the subqeuent 3 decades. What's the bigger picture around this? Can this be balanced so that savings accounts yield a comparable rate to a vanguard?

@approxinfinity said in 401k and pensions:

Alright. I need to read more into the CCP @jadero. @skeet yeah, clearly that isn't going to work.

I understand that 401ks protect peoples money by diversifying their retirement; but this still is dependent on the market constantly going up, and a steady rate of inflation.

The other part I'm wondering about is savings account rates. In the 80s the Fed rates caused savings account to return 8-15% and this has gone down to almost nothing over the subqeuent 3 decades. What's the bigger picture around this? Can this be balanced so that savings accounts yield a comparable rate to a vanguard?

Fed Chair Volcker needed to whip inflation so the Fed cranked interest rates up over 20% to do it. Which in the short term was an economic disaster but eventually caused inflation to remain low and steady until Covid. Everything is pegged to the U.S. Treasury market so interest rates that high on savings accounts would mean fiscal armageddon for the country. We already spend more on debt service than defense and increasing interest rates by even a few points could be catastrophic.

-

@approxinfinity said in 401k and pensions:

Alright. I need to read more into the CCP @jadero. @skeet yeah, clearly that isn't going to work.

I understand that 401ks protect peoples money by diversifying their retirement; but this still is dependent on the market constantly going up, and a steady rate of inflation.

The other part I'm wondering about is savings account rates. In the 80s the Fed rates caused savings account to return 8-15% and this has gone down to almost nothing over the subqeuent 3 decades. What's the bigger picture around this? Can this be balanced so that savings accounts yield a comparable rate to a vanguard?

Fed Chair Volcker needed to whip inflation so the Fed cranked interest rates up over 20% to do it. Which in the short term was an economic disaster but eventually caused inflation to remain low and steady until Covid. Everything is pegged to the U.S. Treasury market so interest rates that high on savings accounts would mean fiscal armageddon for the country. We already spend more on debt service than defense and increasing interest rates by even a few points could be catastrophic.

@RedLyonRegular alright. But the national debt is arbitrary right? Its essentially debt to our citizens so its acceptable as long as it doesnt increase too quickly? So cant we raise the rates enough to make bonds / treasury based 401k a viable savings option?

If you don't want to invest in stocks, you can have an entirely Treasuries based 401k. Will it yield much? No, but it's an option!

-

Questions about this, and I apologize for asking before research. Call it being a conversationalist or being lazy or bringing those playing at home along for the mental process (yeah, thats it!)

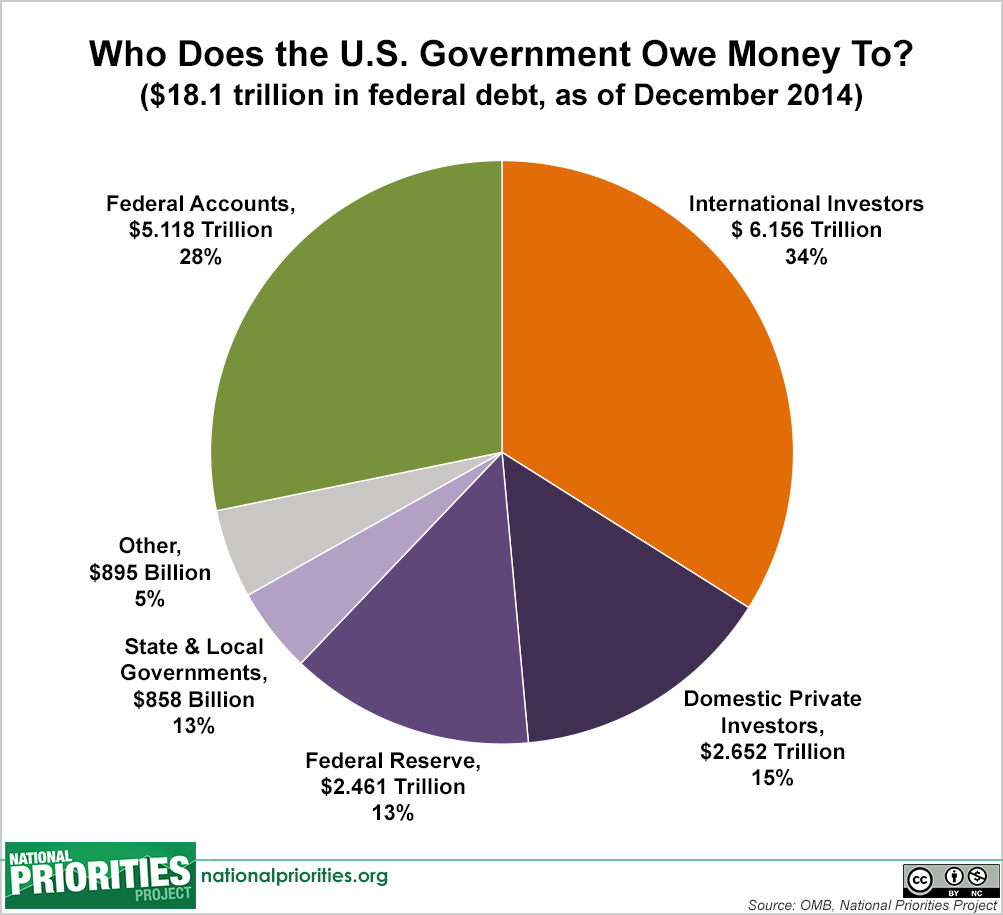

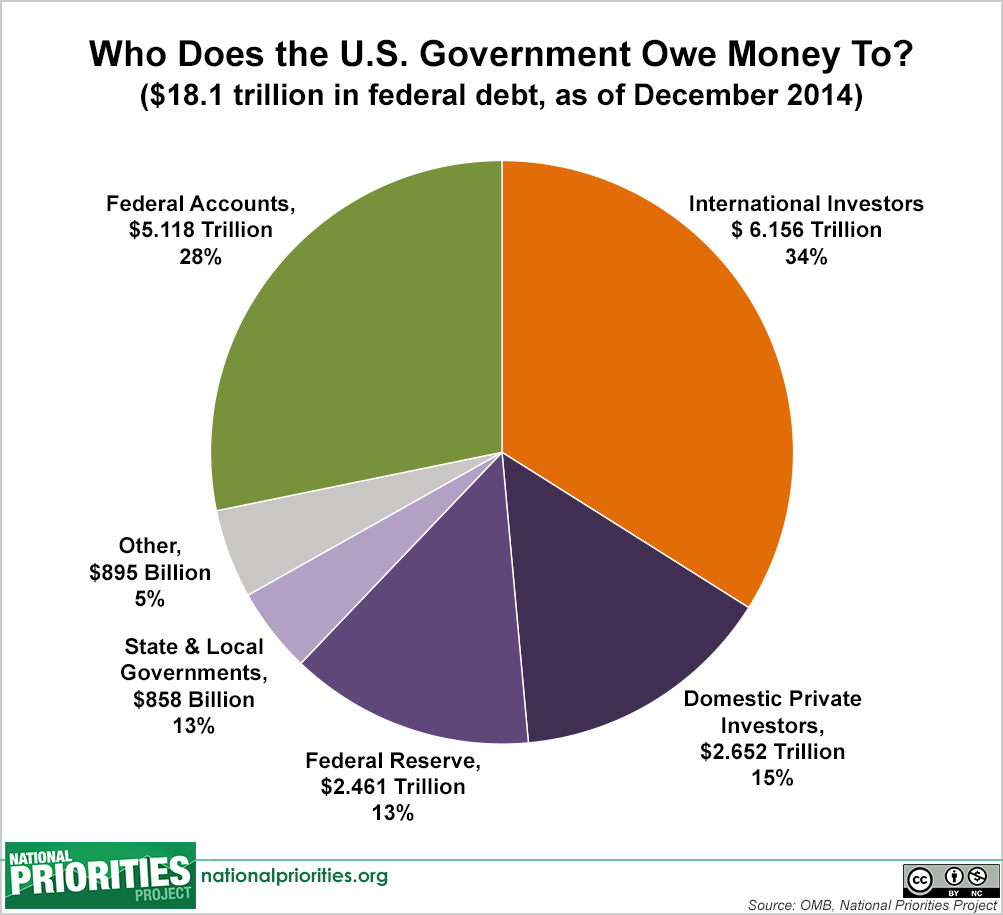

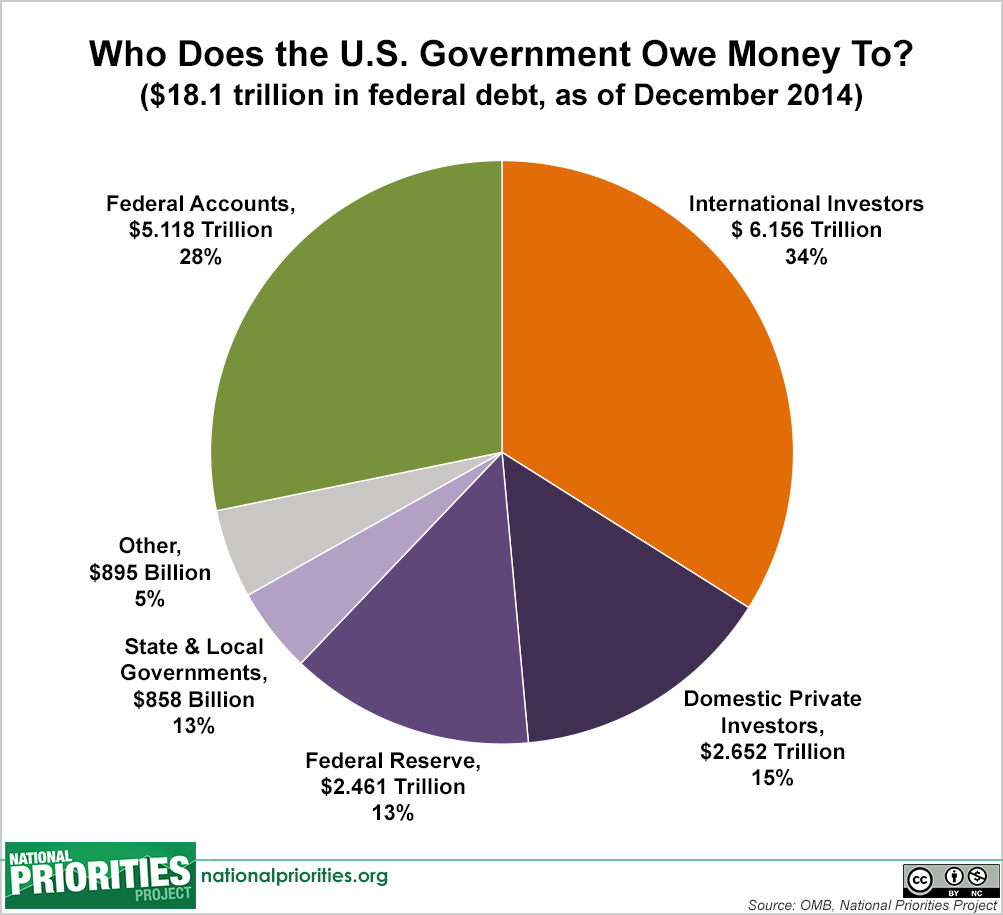

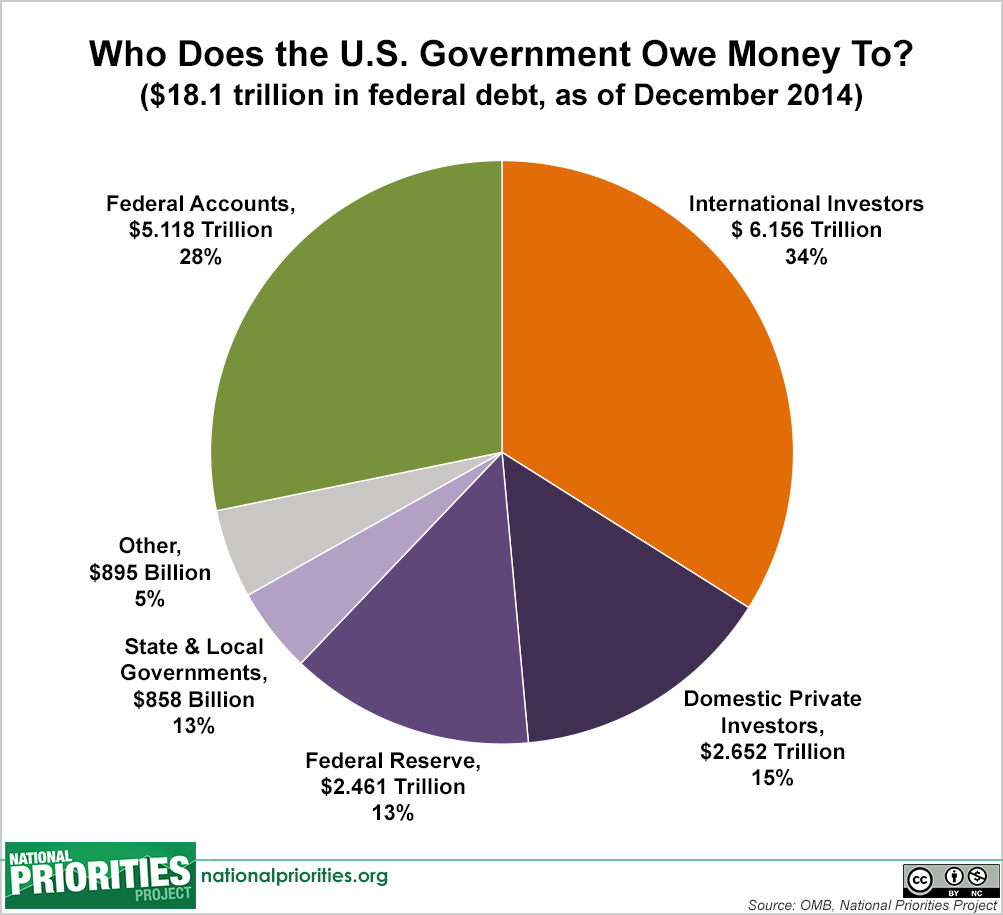

So if we increase interest rates can we increase the debt in certain sectors of this graph? For instance, can we only sell bonds to domestic entities?

And more broadly, is there a creative way to increase interest rates that hasnt been explored?

-

why do we want high interest rates? isn't that just going to make housing more unaffordable? and push investors to look for higher rates of return, pushing capitalists to look for even more growth and rising externality costs? favoring those that have capital over those that don't? it felt like things were going pretty well when we were in ZIRP world. maybe that's just tech.

also, i'm not an economist but the flip side of Chase offering the lowest interest rates on their savings accounts is that they also offer the lowest rates on their mortgages and other loans. maybe because they are sitting on mountains of cash and are trying to invest that money as opposed to the Wealthfront's of the world that are trying to bring cash in. i could be totally wrong. not an economist.

-

@ilam.fields so since 2000 inflation has gone up 88% in the US, while housing costs have gone up 175%. I think the low interest rates helped allow sellers to jack up prices.

-

Questions about this, and I apologize for asking before research. Call it being a conversationalist or being lazy or bringing those playing at home along for the mental process (yeah, thats it!)

So if we increase interest rates can we increase the debt in certain sectors of this graph? For instance, can we only sell bonds to domestic entities?

And more broadly, is there a creative way to increase interest rates that hasnt been explored?

@approxinfinity said in 401k and pensions:

Questions about this, and I apologize for asking before research. Call it being a conversationalist or being lazy or bringing those playing at home along for the mental process (yeah, thats it!)

So if we increase interest rates can we increase the debt in certain sectors of this graph? For instance, can we only sell bonds to domestic entities?

And more broadly, is there a creative way to increase interest rates that hasnt been explored?

I love this stuff so it’s good! The issues are 1) debt is postponing future taxes; 2) sovereign debt crowds out private investment and slows growth. A good example of this is Japan. Their debt burden is extremely high and they haven’t grown much for decades. Increasing debt service payments also has the effect of increasing taxes on us all or replacing other programs that could be useful. Our tax money is increasingly just paying bondholders instead of other uses like paying down debt, bolstering defense, or whichever programs we could prioritize. The crowding out effect is where private money goes to Treasuries instead of venture capital, stocks, or other investments that could actually grow the economy. It’s ok in an emergency but, kind of like your household, you don’t want to rack up high interest credit card debt in your everyday life.

-

@approxinfinity said in 401k and pensions:

Questions about this, and I apologize for asking before research. Call it being a conversationalist or being lazy or bringing those playing at home along for the mental process (yeah, thats it!)

So if we increase interest rates can we increase the debt in certain sectors of this graph? For instance, can we only sell bonds to domestic entities?

And more broadly, is there a creative way to increase interest rates that hasnt been explored?

I love this stuff so it’s good! The issues are 1) debt is postponing future taxes; 2) sovereign debt crowds out private investment and slows growth. A good example of this is Japan. Their debt burden is extremely high and they haven’t grown much for decades. Increasing debt service payments also has the effect of increasing taxes on us all or replacing other programs that could be useful. Our tax money is increasingly just paying bondholders instead of other uses like paying down debt, bolstering defense, or whichever programs we could prioritize. The crowding out effect is where private money goes to Treasuries instead of venture capital, stocks, or other investments that could actually grow the economy. It’s ok in an emergency but, kind of like your household, you don’t want to rack up high interest credit card debt in your everyday life.

@RedLyonRegular alright, so it seems like what i want is for the fed rate to be 6% instead of the 3.88% it is at now.

This makes savings interest rates of 5% feasible.

It slows the tech and growth stocks. I want this, this kneecaps the tech sector and loosens Wall Streets chokehold on our economy.

It raises interest rates on loans and slows the economy. I want this, it forces the houses and automarkets to stop inflating the cost of houses and cars. It stops people from taking on debt they cant repay.

It slows inflation. We want this. We want interest rates to outpace inflation.

In addition to keeping inflation low if we can break up monopolies, we keep companies from arbitrarily jacking prices.

… why arent we doing this @RedLyonRegular ?

-

I'm not an economist, but I enjoy reading about aspects of it and I've thought briefly about societal benefits to different types of retirements. So, my quick take on that is that you have issues of trust on both sides. If you have a defined-contribution retirement account (like a 401K; a less US-centric term), then you put trust in the individual and avoid the issue of trusting the entity that would be doling out pensions (whether company or government). This means you take on the risk of some people saving too little, or living much longer than they expect. If this happens, what do you do with elderly folks that don't have a source of income or family to take care of them? It's inhumane to let them die on the street, so you want some kind of safety net. In a place with robust safety nets, maybe those apply well enough to old people that you don't need something special. If you have a defined-benefit plan (pension), then you trust the entity administering it rather than the person. If it's a company, you trust them not to go out of business or shadily change the terms of the pension. If it's a government, you trust them to model demographics and fund appropriately so that the system remains solvent. There are issues of tying up that capital where young workers can't use it for things like housing, which can harm the economy in certain circumstances. So, personally I am a fan of defined-contribution plans as the primary retirement income--what people rely on for living a good, comfortable life. But, you have a government safety net that gives basic quality of life to those who don't have enough retirement. Of course, there are plenty more questions on the size of contributions, etc that can have major effects.

In terms of interest rates (and many things), I like the golden mean approach. Having rates too close to 0 causes problems but so does having high rates. @approxinfinity while low interest rates can help the tech sector, I don't think that high rates do much to cripple it--other sectors would likely be hit first. In terms of collective action, I think having better regulations on interest rate disclosures and speed of changing would be most impactful. For the US, re-teeth the CFPB and institute some laws about how much rates can be changed within a year (maybe with exceptions when the Fed changes by more than that amount). This could help avoid predatory lending and banks giving a high interest rate for a short period to get people to start accounts, then lowering it (causing the switching cost dilemma for people).

-

@pastvulcan gotcha. While defined-contribution retirement over defined-benefit retirement does seem to be the consensus, i think the question i have is whether we can move it away from stocks. I had been kind of throwing “401k” around meaning “managed fund”, which typically is in large part stocks. As @RedLyonRegular pointed out, we can elect to put 401ks into bonds but that definitely isnt the norm.

So my question i think with a little more precision is “can we make the interest rates on other managed fund options besides stocks competitive? And can we force a mix that is less stock heavy?” theres plenty of runway i think still to discuss what the effect of that may be on companies and on the economy.

I will have to read up more on what the recent dismantling of the CFPB means for consumers, it sounds like there are still laws like the Truth In Lending Act but the CFPB was the main agency to enforce that. Thanks for bringing this up.